Shares - 12 June 2010

I’m going to put a few brief notes down about the (admittedly tiny) trades that I make. Mainly for my own benefit as I look back to see why I did certain things.

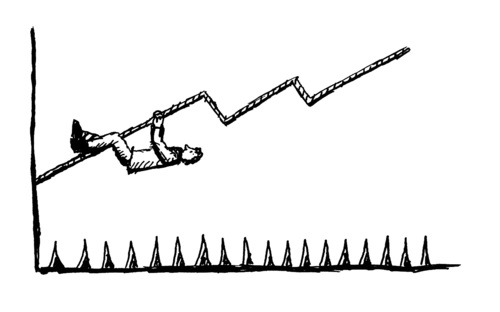

I’m betting on Google for three key things: 1. As a strong player (and a hedge against Apple) in the mobile web and smartphones. I have a feeling that Android will become the mainstream phone OS, replacing Symbian. Google will benefit mostly from the tight integration with its own products, and control over advertising on this operating system. 2. Enterprise products. Everybody swears by GMail at home, but at work they’re stuck using Outlook, Lotus Notes, or some godawful webmail interface. Google Calendar, Maps, Reader, Apps etc are all strong - I use them all but I suspect most people don’t. Enterprise customers are going to start moving across to Google’s services. The University of St Andrews has moved across to GMail, this can only have a positive effect on enterprise uptake.

3. Online advertising. Google’s core revenue remains search advertising and Adsense. I’m a sceptic on advertising, but I think that Google’s services are measurable, accessible and affordable. They also actually deliver some results - advertising spend is going to continue moving online. Example: BP buying up “oil slick” keywords on Google to combat negative PR over the Mexico disaster. Which leads us to…

BP

Any massive fines against BP will turn into a diplomatic issue quickly - the UK can’t afford to see large amounts of its pension funds wiped out. Ultimately, I’m betting that the economy wins out against the environment.

I expect to see heads roll on the BP board, a hefty fine, and regulatory changes over oil drilling in the US.

Penalties against BP will raise the price of oil (directly, and through increasing the overall costs of extraction to avoid future penalties). There is also (so I am told) the prospect of BP being acquired, though I don’t see this as particularly likely.

Watching

Apple

I’m waiting to buy into Apple. The iPod is now the only MP3 player worth mentioning (nine years after launch). The iPhone remains far and away the best phone available (three years on). I think the iPad is awesome but, at least in its current form, it’s not going to replace a phone or a desktop computer for most people. Apple now control the hardware, the operating system, the markets for audio, apps, video, books (from which they make c. 30%).

I’m waiting to buy because historically Apple shares have dipped in the month following their product launch (iPhone 4G just announced).

RIM / Nokia

Microsoft are taking a beating on all fronts when it comes to mobile. Their mobile operating system is going nowhere, and is seeing little support from manufacturers.

If Microsoft wants to stay up with the move to mobile they are going to have to do something - Google (through Android) and Apple are going to force them out. I am wondering whether Microsoft will buy RIM or Nokia to stay in the game, but at the moment I think it unlikely.

HTC

I’d look at buying HTC but they’re traded on the Taiwan market and it seems fairly hard to buy into.

Begbies Traynor

Begbies have shown a steady decline for two years despite the slowdown of the economy. Now trading at c. 60p. Begbies’ focus is on SME windups in the regions - they claim the HMRC have deferred a huge number of these insolvencies through their Time-to-Pay scheme and by not pursuing winding up orders. This backlog of insolvencies has to come through some time, so perhaps now might be the time to buy in. My hesitation is that Begbies structure is different to most insolvency practices - Insolvency Practitioners are largely employees rather than owners, so perhaps there isn’t the hunger that is found in other firms.