This is just a quick update (and mainly a reminder for myself) on where I’m at with shares.

I’ve not made any changes over the last few months but today I had a quick refresh:

Google - Up 9%

Has just released outstanding earnings for the first quarter. That saw a 13% after-hours gain on a $192bn market cap - that in itself is exceptional. Around $20bn in wealth generated in an hour. My thoughts on Google remain the same - their advertising actually works, both for advertisers and consumers. It’s a more transactional environment than Facebook and for advertisers looking to sell something off a click Google is the best choice.

Google’s results have been getting worse recently but there’s no competitor (on search) in sight and they seem to be getting on top of things with their new Panda algorithm. Google Plus is getting a lot of hype, but then so did Wave and that’s bombed. I haven’t managed to get into Plus at all (nor did I ‘get’ Wave). I have a feeling that Plus might do well against Tumblr, Twitter, Posterous et al.

Apple - Up 19%

Apple are absolutely flying. The iPhone is the best phone, the iPad is the best (and arguably only viable) tablet, and the Macbook Pro and Air range of laptops are the best laptops on the market. In a world where people spend a huge proportion of their time using smartphones/computers, and where increasing numbers of people are using them as their primary tool to earn money, spending £1,200 on a laptop is justifiable and actually makes sense. People are happy to spend £1,000 on a TV, but spend 5x more time interacting with their phone - which at £500 is a bargain.

I’ve recently explored the Android handset market and it’s a crock of shit. Just like competing tablets, comparable Android handsets seem to be around the same price as the iPhone. My prediction is that Apple are going to start shipping serious numbers of Macbooks and begin to dominate the top-end laptop market, just as they have done with mobiles and iPads. The Apple TV hasn’t hit the right spot yet. I still can’t bear the Mac operating system.

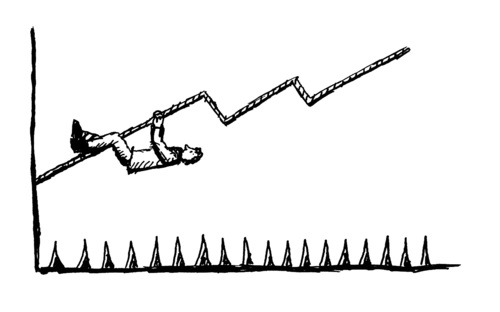

Begbies Traynor - Down 33%

This has been a real shitter. I bought into Begbies at an average of around 60p, watched it rise to 80p and then fall down to 40p. I took a 33% loss on selling, and it’s been a real dog. I was initially betting on a rise in insolvency work but this never materialised, largely due to low interest rates and a passive approach to debt recovery from banks. I’m not sure what the end-game is in this situation as there are plenty of unviable businesses continuing to trade who must ultimately be closed down. Later, when the price dipped to its lows, I was hoping for the founder, Ric Traynor, to step in and take the company private again. I should have taken my loss on this earlier.

Kingfisher - New purchase

I took my Begbies proceeds and rolled them into Kingfisher, which I think is a solid bet. Kingfisher owns B&Q and Screwfix. Both have really strong prospects and I see strong management with innovation.

B&Q has seen Focus DIY go out of business, and Wickes can’t be far behind. That will leave B&Q and Homebase as the only DIY retailers standing. And unlike HMV, who are the last-man-standing in their industry, DIY is not a dead market. I’ve seen some great stuff from B&Q recently (and god knows I’ve spent enough time and money in there). When Focus went under they put up cheeky little signs in the stores - “B&Q welcomes out new Focus DIY customers”. Brilliant. They’ve got a 10% off card for oldies on a Wednesday and the store is packed out. They’ve launched Tradepoint to get the tradesmen into the store - going up directly against Jewson and builders’ merchants (and also cannibalising some of their own Screwfix market). The staff often actually know what they’re talking about - at least 60% are retired folks, often tradespeople.

A couple of things B&Q have nailed - they’ve got hourly van rentals in the car park, in partnership with Hertz. They have also built little classrooms in stores and run training sessions for the public on tiling, laying laminate flooring etc. I LOVE this idea.

Screwfix is Argos for makers. It’s brilliant - cheap chinese made kit, alongside pro-quality tools. Compare Screwfix with any of the trade-type suppliers (Plumb/Build Centre, Jewsons, CityElectrical/Plumbing etc.) - these useless bastards don’t even have their prices/catalogs online. And they are more expensive. And you get treated like a dick in there. I fucking can’t stand the places. Screwfix just does what I need, and I know they’re making a killing doing it. It’s going after a huge market and I think it’s going to win.

I’m sitting on a bit of BP still but no movement there. It’s just a hedge against being too tech-focused really.